Nero d’Avola is one of the most beloved grape varieties in Sicily. Known for its beauty and elegance, it is known for its bright red color and bold fruit flavors. In spite of its deep complexity, it is also known for its austerity, which is evident with every luxurious sip.

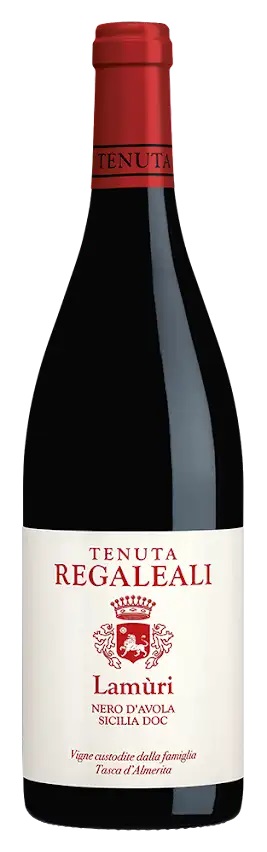

Tenuta Regaleali Lamuri Nero d’Avola Sicilia DOC 2020 ($16) is one of the best-known and most treasured representatives of this most coveted grape variety. For those unfamiliar with the delights of Nero d’Avola, Tenuta Regaleali is the perfect introduction.

Nero d’Avola is hailed as the powerhouse of Sicilian wines. Often referred to as the “Black Grape of Avola,” it has thrived in the island’s unique terroir for centuries. With it vibrant fruit and subtle spice, it is the essence of the legendary Mediterranean sun.

Appreciated for its balanced and versatility, Regaleali Nero d’Avola is made from 100% Nero d’ Avola grapes which were hand harvested before fermentation in temperature controlled stainless steel tanks and aging in 50% large Slavonian oak barrels for 6 months.

Considered the winery’s ‘first born,’ the wine is a classic example of Sicily’s most planted native red grape variety.

This is a terrific wine for spring. It is great with an elegant dinner of grilled leg of lamb, or equally at home with barbecued burgers or coal-fired pizzas. Grilled vegetables brushed with olive oil and fresh Rosemary is the perfect accompaniment. Throw in a fresh garden salad covered in frfesh olives and slices of ripe tomatoes from the vine and you have an al fresco lunch or dinner equal to what is served in southern Italy. For more visit tascadalmeritawww.tascadalmerita.it/en/wines/