Discover how Percival Everett’s “James” sheds new light on Huckleberry Finn’s Jim, redefining American literature and challenging literary norms.

Percival Everett’s latest novel, “James,” emerges as a brilliant, action-packed reimagining of Mark Twain’s classic, “Adventures of Huckleberry Finn,” from the perspective of the enslaved Jim. In this riveting narrative, Everett dives into Jim’s agency, intelligence, and compassion, casting a new light on a character traditionally relegated to the sidelines.

The story unfolds as Jim overhears plans to sell him in New Orleans, tearing him away from his wife and daughter. Determined to avoid this fate, he opts to hide on Jackson Island, setting the stage for an enthralling journey. Meanwhile, Huck Finn, having faked his own death to escape his abusive father, embarks on his own quest for freedom.

Drawing on Twain’s iconic narrative landmarks—encounters with floods, storms, scams, and unexpected twists along the Mississippi River—Everett injects fresh perspective. Jim emerges not merely as a passive figure accompanying Huck but as a dynamic protagonist navigating the perils of a divided nation.

Everett’s mastery lies in his ability to infuse the story with electrifying humor and incisive observations. Through Jim’s eyes, readers witness the complexities of race, freedom, and morality in antebellum America.

The novel becomes a testimonial to Everett’s skill in blending historical insight with contemporary relevance. Moreover, “James” serves as a pivotal commentary on the enduring legacy of “Huckleberry Finn” and its portrayal of race.

Everett navigates the fraught terrain of representation with nuance, challenging the stereotypes and limitations imposed on characters like Jim. In doing so, he offers a powerful critique and celebration of Twain’s work, engaging in a dialogue that transcends literary boundaries.

For Everett, “James” is not merely a retelling but a discourse with Twain, a reclamation of the narrative that Twain was perhaps unequipped to fully explore.

By centering Jim’s perspective, Everett confronts the complexities of slavery and its aftermath, inviting readers to reconsider familiar narratives through a fresh lens.

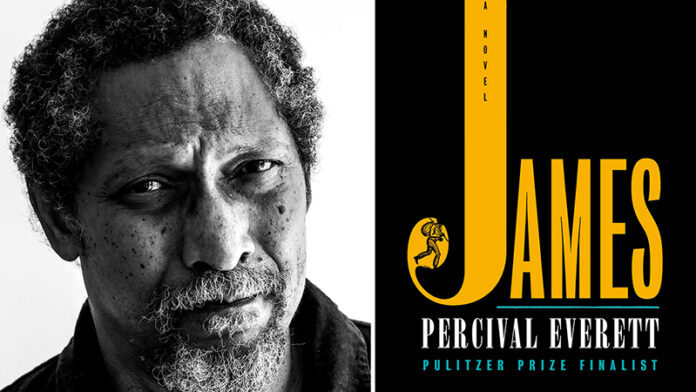

As a distinguished novelist and professor, Everett brings a wealth of expertise to “James,” elevating it beyond a simple reinterpretation. Through meticulous research and imaginative storytelling, he crafts a narrative that resonates deeply with contemporary audiences, challenging them to confront uncomfortable truths while reveling in the timeless power of storytelling.

In “James,” Percival Everett reaffirms his status as one of America’s most visionary writers, pushing the boundaries of literary convention while honoring the rich tapestry of American literature.

With its blend of humor, insight, and social commentary, “James” emerges as a major publishing event and a cornerstone of twenty-first-century American literature.

#literature #Americanliterature #Twain